ACI Form D5 2007-2026 free printable template

Show details

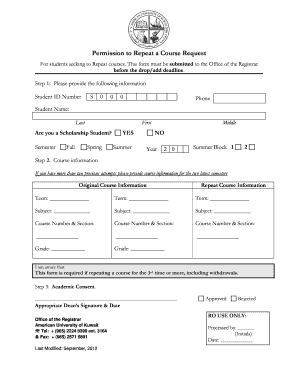

FORM D5 Examinee Application Form November 2007 Specialty Commercial / Industrial Concrete Flatworm Finisher INSTRUCTIONS The applicant must complete both Sections A and B of this form and then forward

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign d5 form

Edit your form d5 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your de 5005 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit d5 application online

To use the professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit aci form. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to deal with documents. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out ACI Form D5

How to fill out ACI Form D5

01

Obtain the ACI Form D5 from the relevant authority or website.

02

Ensure all required personal and company information is at hand.

03

Fill in Section I: Declarant details, including name, address, and contact information.

04

Complete Section II: Consignment details, with an accurate description of the goods.

05

In Section III: Declare any applicable exemptions or special conditions.

06

Review the instructions for any specific requirements related to your shipment.

07

Sign and date the form in the designated area.

08

Submit the completed form to the appropriate authority as instructed.

Who needs ACI Form D5?

01

Importers and exporters who are shipping goods across borders.

02

Customs brokers handling shipments that require formal entry documentation.

03

Companies involved in international trade that need to declare goods to customs authorities.

04

Individuals or entities that need to comply with customs regulations for their shipments.

Fill

form

: Try Risk Free

People Also Ask about

Do I have to pay NY state taxes?

Similar to federal income taxes, states generally impose income taxes on your earnings if you have a sufficient connection to the state or if you earned income in the state even without sufficient connections. So, if you earn an income or live in NY, you must pay NY state tax.

What is NY sales state tax?

Sales and use tax rates in New York State reflect a combined statewide rate of 4%, plus the local rate in effect in the jurisdiction (city, county, or school district) where the sale or other transaction or use occurs.

Why do I owe NY State tax?

A Few Other Reasons You Owe NYS tax Like it or not, tax laws change. You may have lost a property tax deduction or perhaps there is a change in your filing status. If you had good fortune on your side, perhaps you had lottery or gambling winnings.

What is the California corporate tax rate for 2022?

The California corporate tax rate is 8.84% (flat rate). This tax rate applies to C corporations and LLCs that elect to be treated as corporations and report net taxable income (i.e. a profit).

How do you calculate NY state tax?

To calculate the amount of sales tax to charge in New York City, use this simple formula: Sales tax = total amount of sale x sales tax rate (in this case 8%).

What is the state tax for Illinois and 2022?

Illinois Tax Rates, Collections, and Burdens Illinois has a 6.25 percent state sales tax rate, a 4.75 percent max local sales tax rate, and an average combined state and local sales tax rate of 8.81 percent. Illinois's tax system ranks 36th overall on our 2022 State Business Tax Climate Index.

How much is federal and state tax in Illinois?

Your Income Taxes Breakdown TaxMarginal Tax Rate2021 Taxes*Federal22.00%$9,600FICA7.65%$5,777State5.97%$3,795Local3.88%$2,4924 more rows • Jan 1, 2021

What happens if you don't pay NY state taxes?

If you do not pay your tax when due, we will charge you a penalty in addition to interest. The penalty may be waived if you can show reasonable cause for paying late. The penalty charge is: 0.5% of the unpaid amount for each month (or part of a month) it is not paid, up to a maximum of 25%

How do I figure out the tax on a total amount?

Sales tax calculator works out the tax imposed on the sale of goods and services.How do I calculate sales tax backwards from the total? Subtract the net price from the gross price to get the tax amount. Divide the tax amount by the net price. Multiply the result of step 2 by 100. The result is the sales tax.

What is Illinois state tax?

Individual Income Tax 4.95 percent of net income.

What is the state income tax rate in California?

The state income tax rates range from 1% to 12.3%, and the sales tax rate is 7.25% to 10.75%.California Income Tax Brackets and Rates: Head of Household. If your California taxable income is over:But not over:Your tax is:$0$17,8761% of your income8 more rows

What is the NYS sales tax rate for 2022?

Introduction. Sales and use tax rates in New York State reflect a combined statewide rate of 4%, plus the local rate in effect in the jurisdiction (city, county, or school district) where the sale or other transaction or use occurs.

How do I avoid paying New York State taxes?

Table of Contents Avoid or Defer Income Recognition. Max Out Your 401(k) or Similar Employer Plan. If You Have Your Own Business, Set Up and Contribute to a Retirement Plan. Contribute to an IRA. Defer Bonuses or Other Earned Income. Accelerate Capital Losses and Defer Capital Gains. Watch Trading Activity In Your Portfolio.

What is NY state income tax?

New York state income tax rates are 4%, 4.5%, 5.25%, 5.9%, 5.97%, 6.33%, 6.85%, 9.65%, 10.3% and 10.9%. New York state income tax brackets and income tax rates depend on taxable income and filing status.

What is California's state tax 2022?

California state tax brackets and income tax rates depend on taxable income and filing status. Residency status also determines what's taxable. For tax returns filed in 2022, California state tax rates run from 1% to 12.3%. A 1% mental health services tax applies to income exceeding $1 million.

What is NY state tax?

New York Tax Rates, Collections, and Burdens New York has a 4.00 percent state sales tax rate, a max local sales tax rate of 4.875 percent, and an average combined state and local sales tax rate of 8.52 percent.

How much is NY state tax on income?

New York state income tax rates are 4%, 4.5%, 5.25%, 5.9%, 5.97%, 6.33%, 6.85%, 9.65%, 10.3% and 10.9%. New York state income tax brackets and income tax rates depend on taxable income and filing status.

How do you calculate NY state sales tax?

To calculate the amount of sales tax to charge in New York City, use this simple formula: Sales tax = total amount of sale x sales tax rate (in this case 8%).

Who has to pay NY taxes?

Generally, you have to file a New York state tax return if: You're a New York resident and you're required to file a federal tax return or your federal gross income plus New York additions was more than $4,000 ($3,100 if you're single and someone can claim you as a tax dependent).

What is the standard deduction for 2022 in California?

The standard deduction for Single and Married with 0 or 1 allowance has changed from $4,601 to $4,803. The standard deduction for Married with 2 or more allowances and Head of Household has changed from $9,202 to $9,606.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify ACI Form D5 without leaving Google Drive?

pdfFiller and Google Docs can be used together to make your documents easier to work with and to make fillable forms right in your Google Drive. The integration will let you make, change, and sign documents, like ACI Form D5, without leaving Google Drive. Add pdfFiller's features to Google Drive, and you'll be able to do more with your paperwork on any internet-connected device.

Can I create an electronic signature for signing my ACI Form D5 in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your ACI Form D5 and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.

Can I edit ACI Form D5 on an iOS device?

You can. Using the pdfFiller iOS app, you can edit, distribute, and sign ACI Form D5. Install it in seconds at the Apple Store. The app is free, but you must register to buy a subscription or start a free trial.

What is ACI Form D5?

ACI Form D5 is a specific type of customs form used in Canada for reporting certain types of shipments to the Canada Border Services Agency (CBSA).

Who is required to file ACI Form D5?

The importer or the carrier of the goods that are imported into Canada is typically required to file ACI Form D5.

How to fill out ACI Form D5?

To fill out ACI Form D5, one must provide details such as shipment information, importer's information, and details of the goods being imported. This may include descriptions, quantities, and values.

What is the purpose of ACI Form D5?

The purpose of ACI Form D5 is to ensure compliance with Canadian customs regulations by accurately reporting cargo details and facilitating the assessment of duties and taxes.

What information must be reported on ACI Form D5?

ACI Form D5 must report essential details such as the description of goods, the harmonized system (HS) code, the country of origin, the value of goods, and importer's details.

Fill out your ACI Form D5 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

ACI Form d5 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.